Compound interest with withdrawals formula

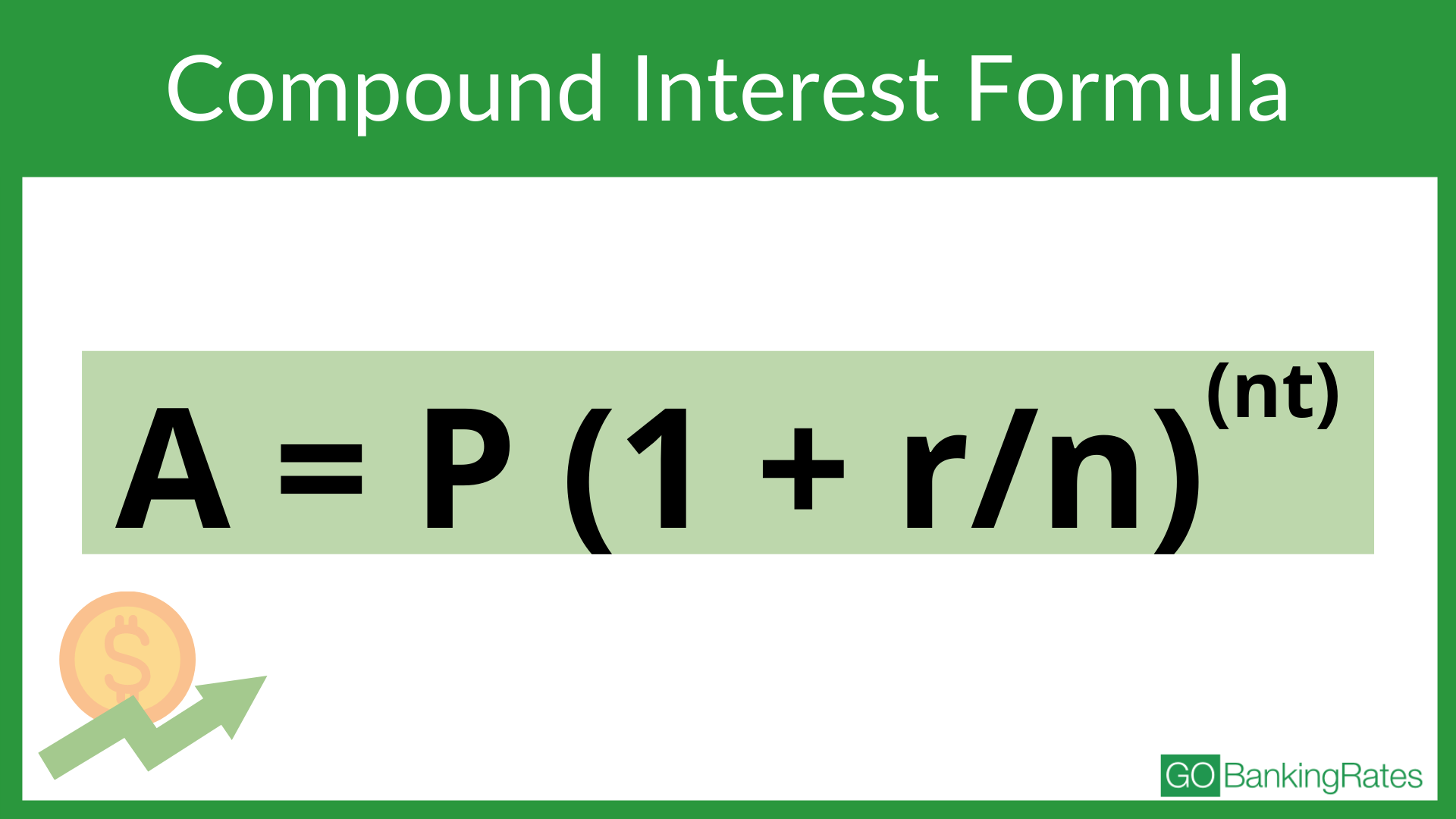

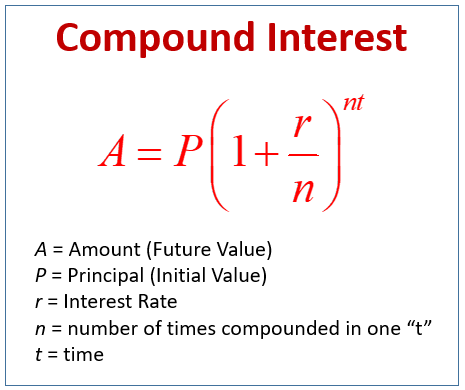

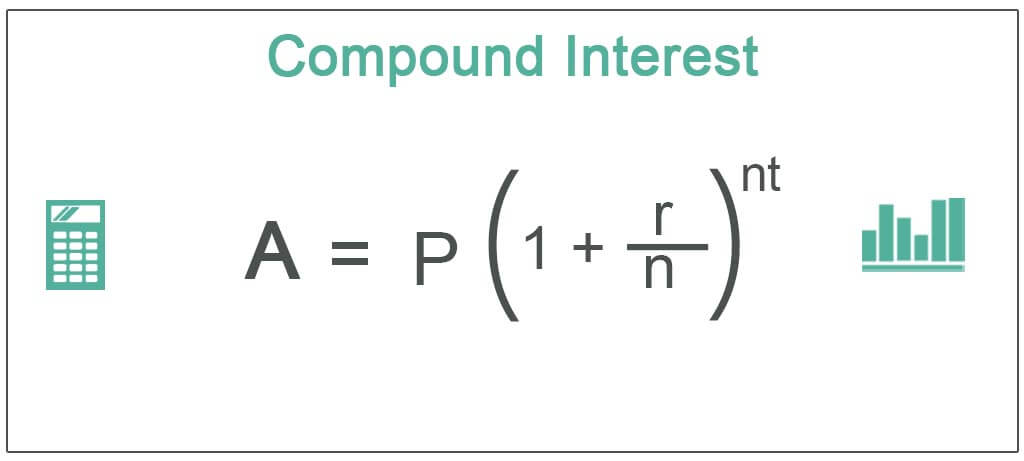

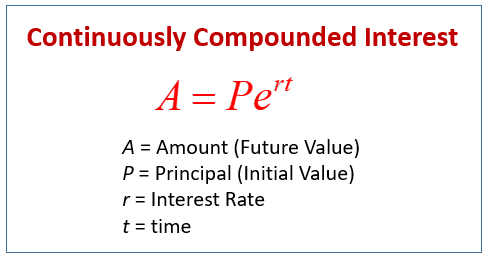

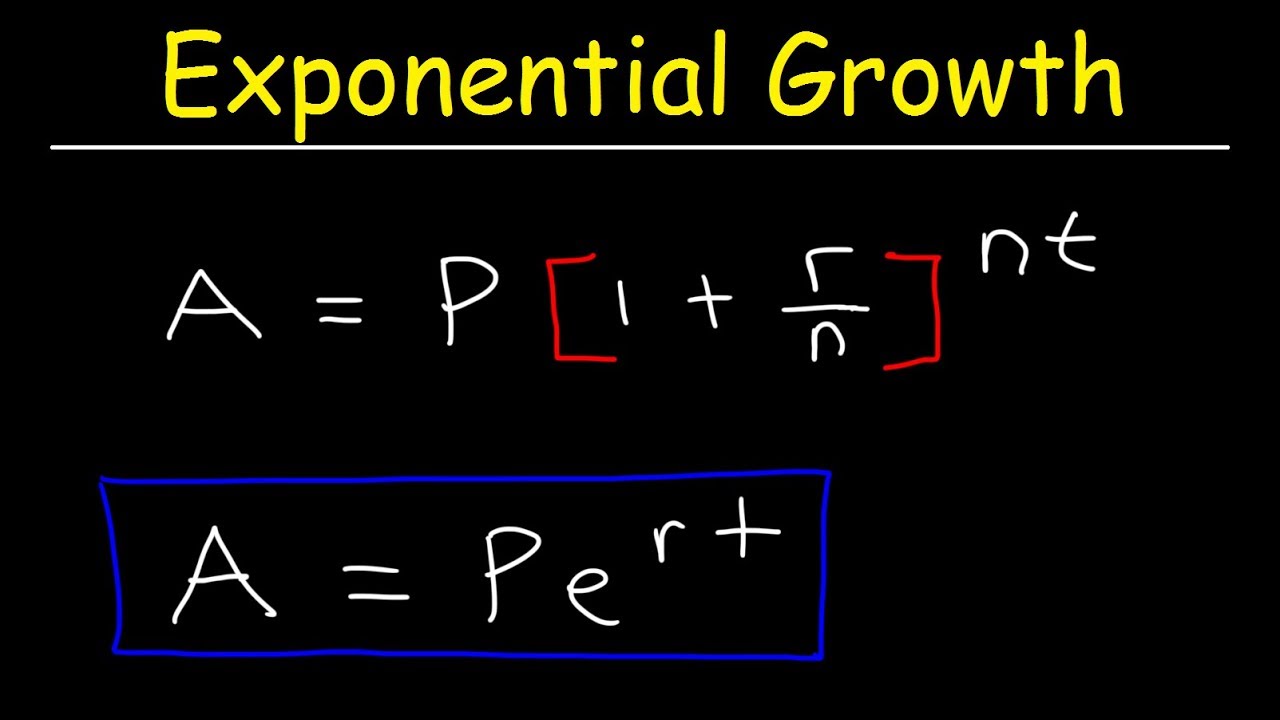

Compound Interest Formulas 1. Formula for compound interest A P 1rnnt Where.

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

What Is The Link Between Mutual Funds And Compound Interest

Consistent investing over a long period of time can be an effective strategy to accumulate wealth.

. The formula in algebraic notation is P x 1 in - W x 1 in - 1 i. I an looking for a formula which returns n for a given combination of. Answer BaseValue1 InterestNumberOfMonths This translate to for example.

R the interest rate decimal A the future value of the investment P the principal investment amount n. R the rate of interest as a percent. Compound Interest Calculator Savings Account Interest Calculator.

It uses the compound interest formula giving options for daily weekly monthly quarterly. The bank wont give. A the future value of the investment or loan P.

If the initial deposit is at the start of year 1 the withdrawals are at the ends of the years indicated and the annual. In this formula i is the annual interest rate n is the number of years P is the original deposit. What this means is that during each month the balance gets multiplied by 1Iit becomes the original amount plus the interest which is Itimes the original amount.

D 100000 n 209124 years. The compound interest formula 1 is as follows. To calculate compound interest we use this formula.

T Total accrued including interest. A P 1 rn nt. Formula for How long until balance 0 with compound interest and withdrawals.

Final Amount P 1 RN N T More frequent interest. The answer is 1070 10 10007 1070 and your earned interest is 070. Our simple savings calculator helps you project the growth and future value of your money over time.

3138428377 1000001 01012 Monthly Compound Interest. In case of compound interest the principal in each time period is different. Even small deposits to a.

Furthermore the balance b in year x is given by. Compound Interest Formula simple This is the simple compound interest formula including initial deposit. So the balance in year 20 is.

1 Where. PA Principal amount. Lets look at how we calculate the year 20 figure using our compound interest formula.

Compound Interest is calculated on the initial payment and also on the interest of previous periods. This is the formula to calculate the total amount of money after a certain amount of time. The formula for Compound Interest is.

In the formula A Accrued amount principal interest P Principal amount r Annual nominal interest rate as a decimal R Annual nominal interest rate as a percent r R100 n number of. The Compound Interest Formula. Roi The annual rate of interest for the amount.

Adding interest gives the amount that can. To calculate the total. And n The number of years Life of the.

Im using this formula. If the initial deposit is at the start of year 1 the withdrawals are at the ends of the years indicated and the annual interest is i to get that withdrawal of 7 at year 5 requires 7 1 i 5. CI P 1 R100 n.

P The amount invested. X 20 b 8476071. You can just discount each of the desired withdrawals.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Formula for calculating interest rate r r n AP1nt-1 Where.

What Is Compound Interest A Guide To Making It Work For You Not Against You Gobankingrates

Word Problems Compound Interest Video Lessons Examples And Solutions

/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

Compound Interest Definition Formula Calculation Invest

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Word Problems Compound Interest Video Lessons Examples And Solutions

How To Find Or Calculate The Principal In Compound Interest Formula For Principal In Interest Youtube

1

26 Compound Interest Formula Exponential Growth Of Money Part 1 Calculate Compound Interest Youtube

3

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

What Is Compound Interest Rocket Mortgage

3

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Compound Interest Calculator With Formula

Pin On Excel Tips

3